The Capital One Spark Cash Plus is a powerhouse credit card designed specifically for small business owners who want simplicity, flexibility, and unlimited earning potential. With its unmatched rewards program offering unlimited 2% cash back on every purchase, this card eliminates the need for tracking categories or limits, making it perfect for busy entrepreneurs who want every dollar spent to work harder for their business.

Beyond its incredible rewards, the Spark Cash Plus offers robust features such as no preset spending limit, generous welcome bonuses, and seamless account management tools. Whether you’re purchasing inventory, booking travel, or covering everyday expenses, this card ensures you maximize value while maintaining financial control and flexibility.

Benefits of the Spark Cash Plus Credit Card

1. Unlimited 2% Cash Back on Every Purchase

With the Spark Cash Plus, there are no categories to track or caps on earning. Every purchase earns 2% cash back, ensuring you maximize rewards on all business expenses, from office supplies to travel, fuel, and more. This simplicity means you can focus on growing your business while the rewards take care of themselves.

2. No Preset Spending Limit

This card adapts to your business needs with no preset spending limit, allowing you to make large purchases when opportunities arise. This flexibility ensures that your spending power grows with your business, making it an invaluable tool for scaling operations or taking advantage of new ventures.

3. Generous Welcome Bonus

Earn a $2,000 cash bonus after spending $30,000 within the first 3 months. This substantial bonus is a fantastic way to kickstart your rewards journey and offset initial expenses for your business.

4. No Foreign Transaction Fees

Conduct international business confidently with no foreign transaction fees. Whether you’re sourcing products globally or traveling for client meetings, you won’t have to worry about additional costs eating into your budget.

5. Annual $2,000 Cash Bonus for Big Spenders

Receive an extra $2,000 cash bonus in the first year when you spend $500,000 or more on your card, rewarding high-volume businesses for their loyalty and spending power.

6. Customizable Employee Cards

Issue employee cards at no extra cost and customize spending limits for better expense management. All their purchases earn cash back for your business, helping you grow rewards faster while maintaining control.

7. Robust Expense Management Tools

The Spark Cash Plus offers detailed expense tracking, downloadable statements, and integration with accounting software. These tools simplify bookkeeping and ensure you stay on top of your business finances with ease.

8. No APR or Interest Charges

This is a charge card, so you pay your balance in full each month with no APR or interest charges. This structure encourages responsible spending while ensuring you avoid interest costs.

9. Seamless Mobile and Online Account Management

Track spending, redeem rewards, and manage employee cards with Capital One’s user-friendly app and online portal. It’s a hassle-free way to keep your business finances organized.

10. Year-End Summaries

Receive detailed year-end summaries that break down spending by category, making tax preparation and financial analysis a breeze for your business.

11. Fraud Protection and Zero Liability

Stay secure with Capital One’s fraud detection systems and enjoy zero liability for unauthorized transactions. Your business is fully protected, ensuring peace of mind while you focus on growth.

12. Travel and Purchase Protections

Benefit from travel accident insurance, purchase protection, and extended warranty coverage on eligible items, giving you additional security for your business-related expenses.

Who Can Apply for the Spark Cash Plus?

Eligibility Criteria for the Spark Cash Plus Card:

- Business Ownership: Applicants must own or manage a small business to qualify.

- Minimum Age: Applicants must be at least 18 years old to apply.

- Credit Score Requirement: A good to excellent credit score is necessary, demonstrating creditworthiness and financial reliability.

- Business Information: Provide details about your business, such as its legal name, annual revenue, and Tax ID or Social Security Number.

- U.S. Residency: The business must operate within the United States, and applicants must be U.S. residents.

How to Apply

- Visit Capital One’s Website: Navigate to the Spark Cash Plus Credit Card page.

- Click “Apply Now”: Begin the application process online.

- Enter Business Information: Provide details about your business, including name, address, annual revenue, and industry.

- Enter Personal Information: Provide your name, Social Security Number, and contact information for credit checks and verification.

- Submit the Application: Review your application and submit it for approval.

- Await Approval: Receive a decision, often within minutes, and if approved, your card will be sent to you.

Frequently Asked Questions

What is the annual fee for the Spark Cash Plus?

The annual fee is $150refunded every year you spend at least $150,000.

Are there employee cards available?

Yes, you can issue employee cards at no additional cost and set individual spending limits.

Can I track my rewards?

Yes, you can monitor rewards in real-time through the Capital One app or online portal.

Is there a penalty for late payments?

Yes, late payments may incur a fee, so it’s essential to pay your balance on time each month.

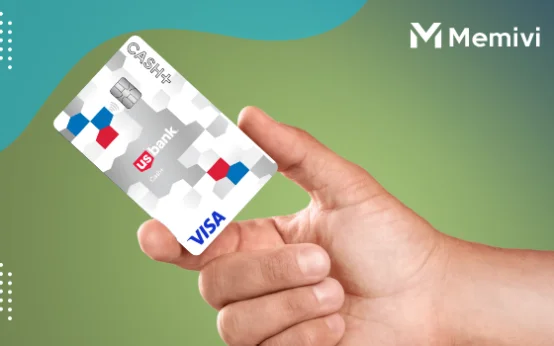

U.S. Bank Cash+ Secured Visa Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock cash back rewards while building credit! Enjoy 5% cash back on your favorite categories, no annual fee, and flexible spending power. </p>

U.S. Bank Cash+ Secured Visa Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock cash back rewards while building credit! Enjoy 5% cash back on your favorite categories, no annual fee, and flexible spending power. </p>  U.S. Bank Smartly Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Experience up to 4% cash back, no annual fees, and exclusive benefits. Take your spending to the next level today! </p>

U.S. Bank Smartly Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Experience up to 4% cash back, no annual fees, and exclusive benefits. Take your spending to the next level today! </p>  The AT&T Points Plus Card from Citi Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Earn big on gas, groceries, and more—no annual fee! Turn everyday spending into exciting rewards with the AT&T Points Plus Card. </p>

The AT&T Points Plus Card from Citi Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Earn big on gas, groceries, and more—no annual fee! Turn everyday spending into exciting rewards with the AT&T Points Plus Card. </p>